Cryptocurrency value prediction

With IG, you can trade cryptocurrencies via a CFD account – derivative products that enable you speculate on whether your chosen cryptocurrency will rise or fall in value. regal assets review Prices are quoted in traditional currencies such as the US dollar, and you never take ownership of the cryptocurrency itself.

Some miners pool resources, sharing their processing power over a network to split the reward equally, according to the amount of work they contributed to the probability of finding a block. A “share” is awarded to members of the mining pool who present a valid partial proof-of-work.

Cryptocurrency prices are much more volatile than established financial assets such as stocks. For example, over one week in May 2022, bitcoin lost 20% of its value and Ethereum lost 26%, while Solana and Cardano lost 41% and 35% respectively. The falls were attributed to warnings about inflation. By comparison, in the same week, the Nasdaq tech stock index fell 7.6 per cent and the FTSE 100 was 3.6 per cent down.

Almost 74% of ransomware revenue in 2021 — over $400 million worth of cryptocurrency — went to software strains likely affiliated with Russia, where oversight is notoriously limited. However, Russians are also leaders in the benign adoption of cryptocurrencies, as the ruble is unreliable, and President Putin favours the idea of “overcoming the excessive domination of the limited number of reserve currencies.”

Welcome to CoinMarketCap.com! This site was founded in May 2013 by Brandon Chez to provide up-to-date cryptocurrency prices, charts and data about the emerging cryptocurrency markets. Since then, the world of blockchain and cryptocurrency has grown exponentially and we are very proud to have grown with it. We take our data very seriously and we do not change our data to fit any narrative: we stand for accurately, timely and unbiased information.

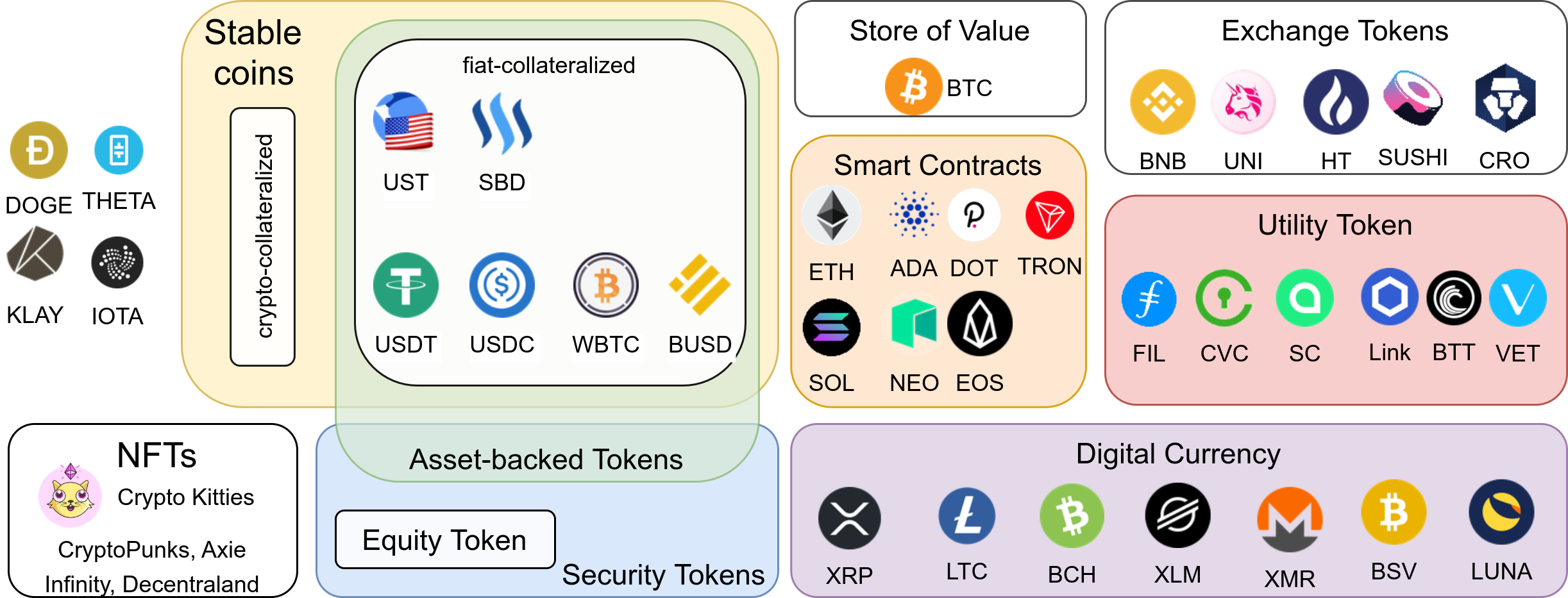

Types of cryptocurrency

Look before you leap! Before investing in a cryptocurrency, be sure you understand how it works, where it can be used, and how to exchange it. Read the webpages for the currency itself (such as Ethereum, Bitcoin or Litecoin) so that you fully understand how it works, and read independent articles on the cryptocurrencies you are considering as well.

Transaction fees (sometimes also referred to as miner fees or gas fees) for cryptocurrency depend mainly on the supply of network capacity at the time, versus the demand from the currency holder for a faster transaction. The ability for the holder to be allowed to set the fee manually often depends on the wallet software used, and central exchanges for cryptocurrency (CEX) usually do not allow the customer to set a custom transaction fee for the transaction. Their wallet software, such as Coinbase Wallet, however, might support adjusting the fee.

Look before you leap! Before investing in a cryptocurrency, be sure you understand how it works, where it can be used, and how to exchange it. Read the webpages for the currency itself (such as Ethereum, Bitcoin or Litecoin) so that you fully understand how it works, and read independent articles on the cryptocurrencies you are considering as well.

Transaction fees (sometimes also referred to as miner fees or gas fees) for cryptocurrency depend mainly on the supply of network capacity at the time, versus the demand from the currency holder for a faster transaction. The ability for the holder to be allowed to set the fee manually often depends on the wallet software used, and central exchanges for cryptocurrency (CEX) usually do not allow the customer to set a custom transaction fee for the transaction. Their wallet software, such as Coinbase Wallet, however, might support adjusting the fee.

The company that manages the peg is expected to maintain reserves in order to guarantee the cryptocurrency’s value. This stability, in turn, is attractive to investors who might use stablecoins as a savings vehicle or as a medium of exchange that allows for regular transfers of value free from price swings.

Cryptocurrency comes under many names. You have probably read about some of the most popular types of cryptocurrencies such as Bitcoin, Litecoin, and Ethereum. Cryptocurrencies are increasingly popular alternatives for online payments. Before converting real dollars, euros, pounds, or other traditional currencies into ₿ (the symbol for Bitcoin, the most popular cryptocurrency), you should understand what cryptocurrencies are, what the risks are in using cryptocurrencies, and how to protect your investment.

How to create a cryptocurrency

If you are simply curious about crypto, then there’s likely no harm in creating your own token. Just make sure to avoid any activities that might be considered an initial coin offering (ICO) by the U.S. Securities and Exchange Commission, as you don’t want to violate any federal securities laws accidentally.

Lastly, you must decide how the coins are burned, such as gas, for transactions on the Ethereum network. You might also consider if your cryptocurrency buys back a certain portion of the outstanding supply on a predefined schedule in order to support the value (such as Binance’s autoburn of its BNB coin).

Now, create your blockchain’s internal architecture and its rules and parameters, such as address and public/private key formats, permissions and how the crypto asset will be issued. Be sure to carefully consider these factors as they cannot be changed without a software upgrade once the platform is running.

If you are simply curious about crypto, then there’s likely no harm in creating your own token. Just make sure to avoid any activities that might be considered an initial coin offering (ICO) by the U.S. Securities and Exchange Commission, as you don’t want to violate any federal securities laws accidentally.

Lastly, you must decide how the coins are burned, such as gas, for transactions on the Ethereum network. You might also consider if your cryptocurrency buys back a certain portion of the outstanding supply on a predefined schedule in order to support the value (such as Binance’s autoburn of its BNB coin).

Now, create your blockchain’s internal architecture and its rules and parameters, such as address and public/private key formats, permissions and how the crypto asset will be issued. Be sure to carefully consider these factors as they cannot be changed without a software upgrade once the platform is running.