If you don’t have a dedicated mining rig or ASICs, chances are you’ll want to ensure mining doesn’t interfere with your computer’s performance while you’re using it. Cudo Miner sits dormant in the background on your computer and will intelligently start mining whatever is most profitable for you when your system is idle.< https://test.com/ /p>

Cudo Miner is a crypto mining platform that allows automated mining, reducing manual configuration and intervention by up to 95% without losing profitability. The solution includes a desktop application and a dedicated Web Console for monitoring and remote management. Cudo Miner is fully automated and optimised for both profit and highest performance on Windows, Linux or CudoOS. Cudo Miner is suitable for miners with all levels of experience.

You get paid continuously. For the automated Cudo Miner, all revenues generated will be held in your Cudo wallet until you choose to withdraw the balance and move into your own Bitcoin or Altcoin wallet. Transactions are subject to minimum transfer amounts based on your chosen payment coin. These amounts are listed here.

Automatic algorithm switching ensures you always mine the most profitable coin. Cudo Miner continuously scans the coin value and difficulty, automatically switching your mining efforts to provide the highest profitability at any given time.

The Cudo Miner Web Console provides a detailed overview of your account, devices and specific device performance. The console can be accessed remotely giving you full oversight of your mining performance wherever you are.

Cryptocurrency stocks

Block is an online digital and mobile payment platform for consumers and merchants and is the parent company of Square and Cash App. Cofounder and former CEO Jack Dorsey believed so strongly in the company’s investments in blockchain and other technologies that he changed the company’s corporate name from Square to Block in December 2021.

CME (ticker: CME) is a financial services company whose businesses include clearinghouse services and derivatives exchanges. Among the products covered by these services are cryptocurrencies, including Bitcoin and Ethereum.

Chipmakers Nvidia and AMD don’t deal with cryptocurrencies directly, but the two semiconductor companies are the leading designers of graphics processing units (GPUs). Best known for powering high-end video game graphics, GPUs now enable computing-intensive applications such as data centers, artificial intelligence, and the creation of crypto assets.

Block is an online digital and mobile payment platform for consumers and merchants and is the parent company of Square and Cash App. Cofounder and former CEO Jack Dorsey believed so strongly in the company’s investments in blockchain and other technologies that he changed the company’s corporate name from Square to Block in December 2021.

CME (ticker: CME) is a financial services company whose businesses include clearinghouse services and derivatives exchanges. Among the products covered by these services are cryptocurrencies, including Bitcoin and Ethereum.

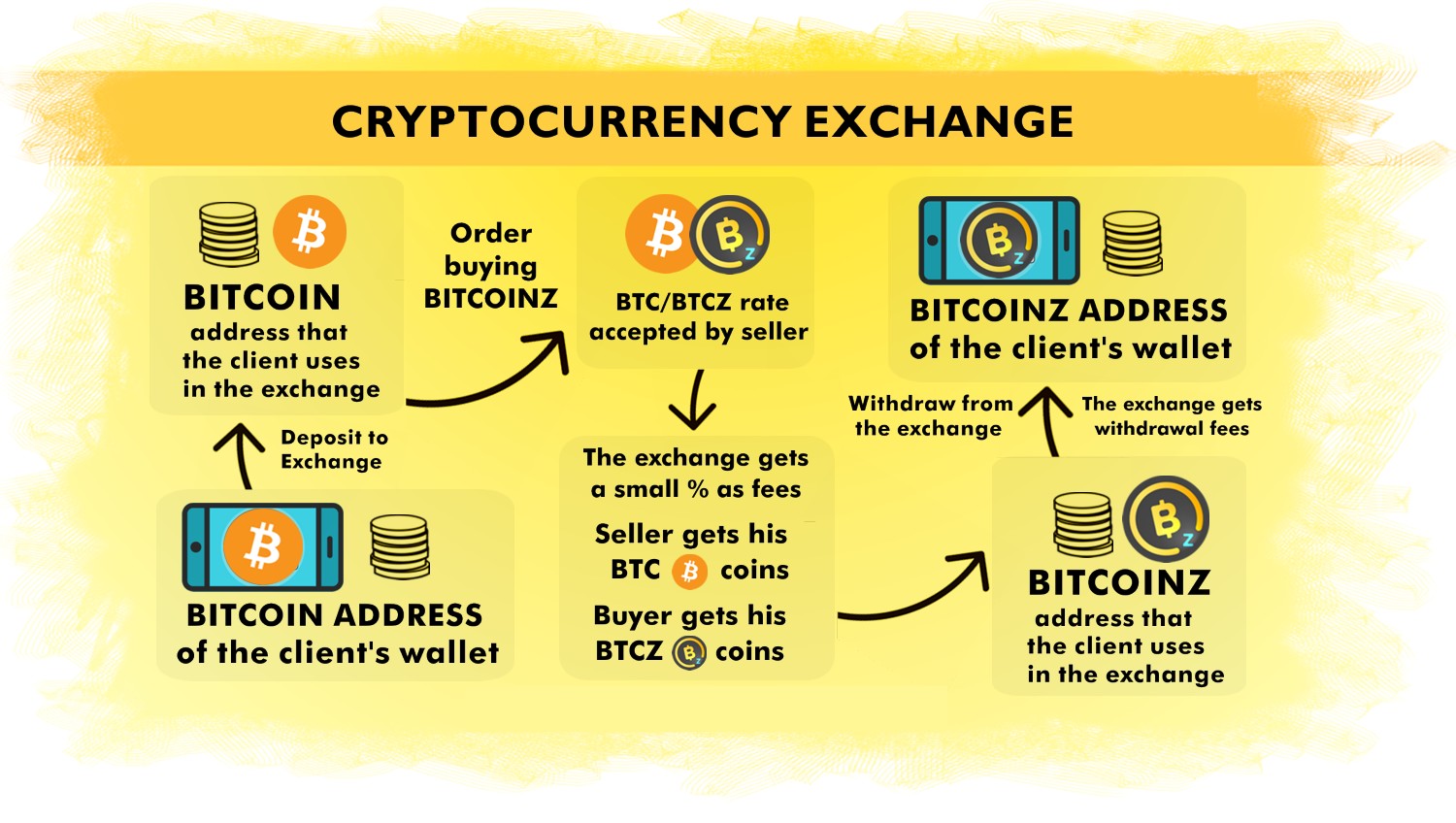

Cryptocurrency exchange

Like most other exchanges on this list, Coinsmart Exchange is also regulated by and fully compliant as a Money Service Business with FINTRAC. They support a range of payment methods for funding your account including bank draft, credit and debit cards, wire transfers and Interac eTransfers. You can also take advantage of same-day funding, making it ideal for anybody who wants to get started with trading straight away.

Crypto.com is a relatively new player in the scene, but has been rapidly making waves with their aim to blend Centralized Exchanges with DeFi a bit by offering a companion wallet app with free withdrawals from the centralized exchange to the companion wallet. Their companion wallet also supports staking and DeFi liquidity pools, without lockups, directly from the wallet app, though I was unable to determine exactly what coins were supported for the staking options.

Coinbase is a bit of a unique beast. It’s the de-facto standard for reputability, having great legal and security history, even going so far as to actively block transfers out to known scam addresses, just to help prevent you from burning yourself. Coinbase is also the primary entry point for the majority of institutional investors for this reason. On the other hand, their coin variety listing is quite bad, they don’t offer margin/options trading, and their trading fees are high for the market at 0.5%. That said, they offer free ACH bank transfers, no withdrawal fees, and their trading fee drops quickly for high volume traders.

Like most other exchanges on this list, Coinsmart Exchange is also regulated by and fully compliant as a Money Service Business with FINTRAC. They support a range of payment methods for funding your account including bank draft, credit and debit cards, wire transfers and Interac eTransfers. You can also take advantage of same-day funding, making it ideal for anybody who wants to get started with trading straight away.

Crypto.com is a relatively new player in the scene, but has been rapidly making waves with their aim to blend Centralized Exchanges with DeFi a bit by offering a companion wallet app with free withdrawals from the centralized exchange to the companion wallet. Their companion wallet also supports staking and DeFi liquidity pools, without lockups, directly from the wallet app, though I was unable to determine exactly what coins were supported for the staking options.

Coinbase is a bit of a unique beast. It’s the de-facto standard for reputability, having great legal and security history, even going so far as to actively block transfers out to known scam addresses, just to help prevent you from burning yourself. Coinbase is also the primary entry point for the majority of institutional investors for this reason. On the other hand, their coin variety listing is quite bad, they don’t offer margin/options trading, and their trading fees are high for the market at 0.5%. That said, they offer free ACH bank transfers, no withdrawal fees, and their trading fee drops quickly for high volume traders.